The three leading indicators gave investors a glimpse into the downs and ups in investing over the past two years, reaching bear territory in 2022 and then rising by double digits last year. It is impossible to predict 100% what the market will do this year, but there is reason to be optimistic about what is to come. This is because history shows us that bear markets always lead to better market times, and that strong times – bull markets – last longer than weak times.

However, there is a type of stock that can offer big rewards no matter what the market is doing. I’m talking about dividend stocks, which pay you passive income every year just for owning them. In rising markets, you’ll often benefit from these stocks’ market performance and additional income — and in more difficult times, dividend payments alone can boost your investment portfolio. Here are the five best dividend stocks I can buy with my fist in 2024.

1. Johnson & Johnson

Johnson & Johnson (NYSE: GING), as the king of dividends, has raised its payouts for more than 50 consecutive years. This track record shows that rewarding shareholders is important to the company, so it’s reasonable to expect this policy to continue.

Johnson & Johnson pays a dividend of $4.76 per share, which represents a yield of 2.95%, beating the S&P 500’s yield. The healthcare giant, which generates more than $15 billion in free cash flow, has what it takes to support an increase Profits financially.

More importantly, more growth may be just around the corner for this company. Last year, Johnson & Johnson spun off its slower-growing consumer health business to focus on its higher-growth pharmaceutical and medical technology businesses. The company expects it will launch 20 new drugs and 50 expansions of existing products by 2030. A third of medical technology sales will come from new products by 2027. So, buying Johnson & Johnson stock now could offer you a nice combination of safety — thanks. To profits – and growth.

2. Coca-Cola

coca cola (NYSE: KO) It also makes the Dividend Kings list after many decades of earnings growth. The company pays $1.84 per share for a 3.06% yield, like J&J, which exceeds the S&P 500 index’s yield.

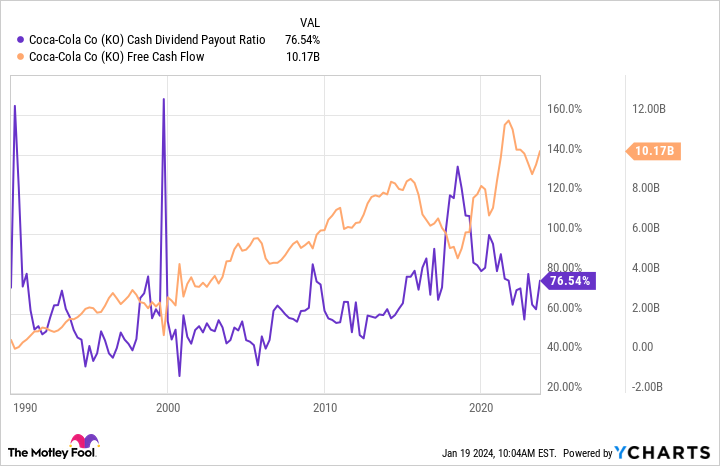

The world’s largest non-alcoholic beverage maker’s cash dividend payout ratio shows that it pays out 76% of its free cash flow as dividends. The company’s growing free cash flow suggests this is clearly sustainable.

What’s driving this cash flow growth is Coca-Cola’s high-quality business, selling its namesake beverages and many other big brands — from Dasani water to Minute Maid juices — that keep customers coming back. Coca-Cola’s solid moat, or competitive advantage, is brand strength, and it has helped the company continue to grow profits even as high inflation impacted consumer purchasing power last year.

Therefore, you can count on Coca-Cola to gradually grow earnings and dividends regardless of the economic environment, making it one of the best stocks to buy and hold for the long term.

3. Abbott Laboratories

I like Abbott Laboratories (NYSE: ABT) For its long history of dividend growth – meet another Dividend King – as well as its diversified healthcare businesses.

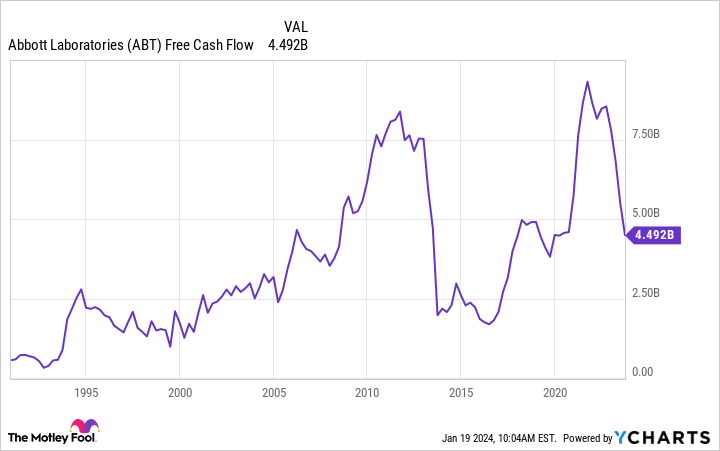

Let’s talk about profits first. Abbott pays a dividend of $2.20 per share for a yield of 1.93%, which exceeds the yield of the S&P 500, and like the companies I mentioned above, Abbott has strong free cash flow to keep the dividend growing. So, when you buy this stock, you can imagine your passive income increasing year after year.

As for Abbott’s business, the company includes four units: medical devices, diagnostics, nutrition, and existing pharmaceuticals. The magic of this is that if one faces certain headwinds, others can offset — and this happened with Diagnostics, as the company’s coronavirus testing went from rising to declining revenue. In the latest quarter, excluding the negative impact of Covid tests, Abbott’s sales rose more than 13% to $10 billion — and all four companies posted double-digit gains.

So, using Abbott’s historical performance as a guide, you can count on consistent earnings growth as it collects more and more passive income year after year.

4. AbbVie

AbbVie (NYSE: ABF) It debuted in 2013 when Abbott spun off its pharmaceutical business, and since then, the new company has increased its profits by 285%. Today, AbbVie pays a dividend of $6.20 per share, a yield of 3.80%.

In its most recent earnings call, AbbVie said earnings growth remains a priority, even today as it goes through a major transition. AbbVie’s best-selling drug, Humira, faces competition in the biosimilar space, and that means lower revenues. But the company has set up two new immunology drugs — Rinvoq and Skyrizi — to take over and surpass Humira’s revenue peak together by the end of the decade.

Rinvoq and Skyrizi, which are on track to achieve $11.6 billion in sales for all of 2023, are on track. On top of that, AbbVie also has a full portfolio of other major drugs in areas including neuroscience and aesthetics, and a promising pipeline as well.

All of this means the stock could deliver increased growth — and profits — as AbbVie approaches its targets.

5. Medtronic

Medtronic (NYSE: MDT) It is another company participating in a transition phase that is set to lead to increased growth. The medical device giant has taken steps to become more efficient, divest companies with slow growth, and invest in growth areas such as artificial intelligence (AI).

At the same time, Medtronic has committed to making earnings growth a priority. In the company’s most recent earnings report, it said it aims to return at least 50% of free cash flow to shareholders each year. In fiscal 2023, it returned $4 billion, or 86% of free cash flow, in the form of dividends and stock repurchases.

Medtronic pays a dividend of $2.76, yields 3.20%, and has been increasing its dividend for over 45 years. Given its priorities for dividend growth, its moves to boost the dividend, and the fact that it’s very close to becoming a dividend king, this is the highest dividend company to buy with a fist this year.

Should you invest $1,000 in Johnson & Johnson now?

Before you buy shares of Johnson & Johnson, consider the following:

the Motley Fool stock advisor The analyst team has just defined what they think it is Top 10 stocks Let investors buy it now…and Johnson & Johnson wasn’t one of them. The 10 stocks that were discounted could deliver huge returns in the coming years.

Stock advisor It provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. the Stock advisor The service has more than tripled the return of the S&P 500 since 2002*.

See stocks 10

*Stock Advisor returns as of January 16, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Abbott Laboratories. The Motley Fool recommends Johnson & Johnson and Medtronic and recommends the following options: Long January 2024 $47.50 calls on Coca-Cola. The Motley Fool has a disclosure policy.

The 5 Best Dividend Stocks to Buy in 2024 was originally published by The Motley Fool