Bitcoin has had amazing highs and lows throughout its history. With cryptocurrency more widely accessible than ever before, some investors may be keen to try to exploit the potential for high returns. However, those looking to add exposure may send tremors through their portfolios. A little can go a long way.

After much anticipation, the Securities and Exchange Commission approved 11 Bitcoin ETFs in early January 2024. Investors can now easily buy and sell the popular cryptocurrency in the same brokerage accounts with which they buy stock and bond ETFs and mutual funds (unless you’re a… Vanguard is your brokerage firm. Since Bitcoin ETFs began trading on January 11, investors have pumped in more than $1 billion in less than a week. Total assets in the new ETFs, including the Grayscale Bitcoin Trust GBTC, which was converted from a collective investment fund, were just under $30 billion.

However, before you rush to add Bitcoin, you should consider how a seemingly small amount can have a large impact on the volatility of your investment portfolio. In this article, we will look at how different amounts of Bitcoin affect the volatility and returns of a traditional 60/40 portfolio.

Bitcoin’s history of booms and busts

It’s tempting to think about adding Bitcoin. It has enjoyed some exceptional returns, including 150% in 2023, 300% in 2020, and 1,300% in 2017. But this rocket ship isn’t just going up, and crashes can be painful. In 2022 and 2018, for example, Bitcoin fell by 64% and 74%, respectively.

Figure 1 shows huge differences in how Bitcoin and the 60/40 portfolio perform. Shows the continuous one-year standard deviation—a measure of volatility—using the daily returns of the S&P Bitcoin Index (launched in May 2021 with performance dating back to January 2014) and a 60/40 underlying stock/bond portfolio composed of Morningstar. The Global Markets and Morningstar U.S. Core Bond Indexes (two broadly diversified indexes representing global equity and U.S. bond markets) are rebalanced monthly.

The cryptocurrency has been on average 10 times more volatile since 2014 and 6.3 times more volatile over the subsequent one-year period.

Where does your portfolio risk come from?

The sources of risk for a 60/40 portfolio can be tricky. It’s easy to assume that 60% of a portfolio’s risk comes from stocks and 40% from bonds. However, 85% of the portfolio risk comes from stocks because they are more volatile than bonds. In light of this, adding Bitcoin, which is more volatile, can significantly change the risk profile of a portfolio.

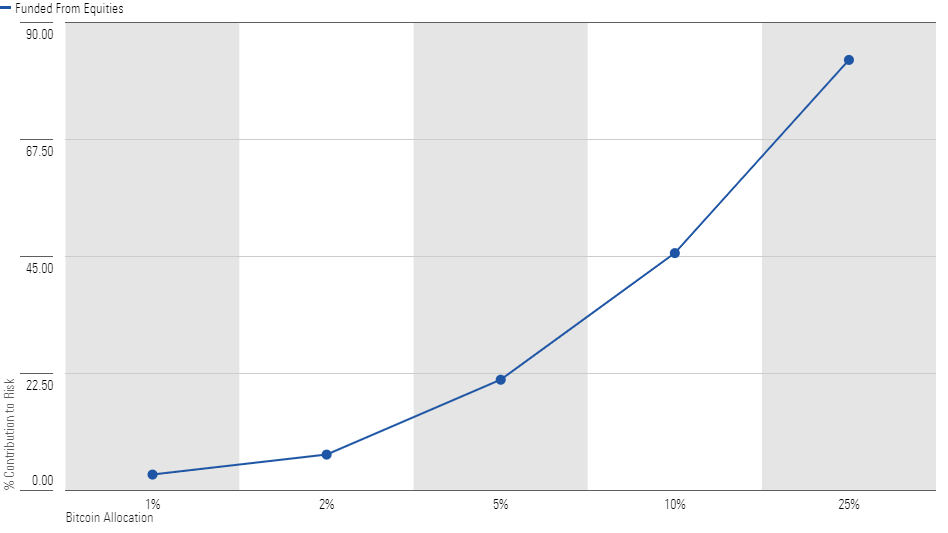

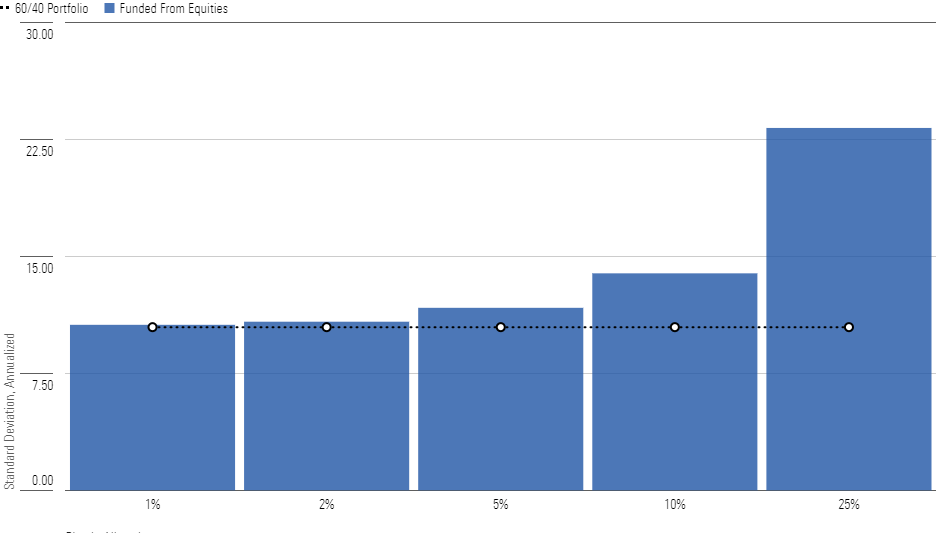

Figure 2 shows the contribution of Bitcoin to risk in a 60/40 portfolio when holding Bitcoin, as approximated by the S&P Bitcoin Index, with different weights (1%, 2%, 5%, 10%, and 25%) and when the allocation is taken from the equity envelope ( Funding something as volatile as cryptocurrency with bonds is not a good idea). Figure 3 shows how the standard deviation of each hypothetical portfolio changed over the period given varying allocations to Bitcoin.

A small dose of 1% or 2% of Bitcoin will not have a significant impact on your investment portfolio. At these levels, Bitcoin contributes about 3% and 7% of the total risk, respectively, and causes little change in overall volatility, as shown in Figure 3.

5% is the tipping point

While a little bit of Bitcoin can go a long way, it is at larger exposures that investors will see the biggest shifts in overall risk to Bitcoin. At 5%, the Bitcoin allocation contributes more than 20% to the total portfolio risk and produces a volatility of about 16% over the 60/40 portfolio. A 10% allocation increases volatility by 41%.

With a 25% allocation, the risk contribution jumps to 83% when acquired from stocks. Overall volatility is more than twice that of the 60/40 portfolio. This should serve as a warning to investors that even a small amount can disproportionately increase portfolio volatility, thus changing the risk composition.

On paper, the portfolios with exposure to Bitcoin are over 60/40

Bitcoin is no stranger to drawdowns in excess of 50%. While it can be easy to get anxious in the face of huge losses, holding on to the dip and even buying it has generally been beneficial for investors who can handle it. Morningstar research has shown that investors typically have more difficulty holding volatile portfolios.

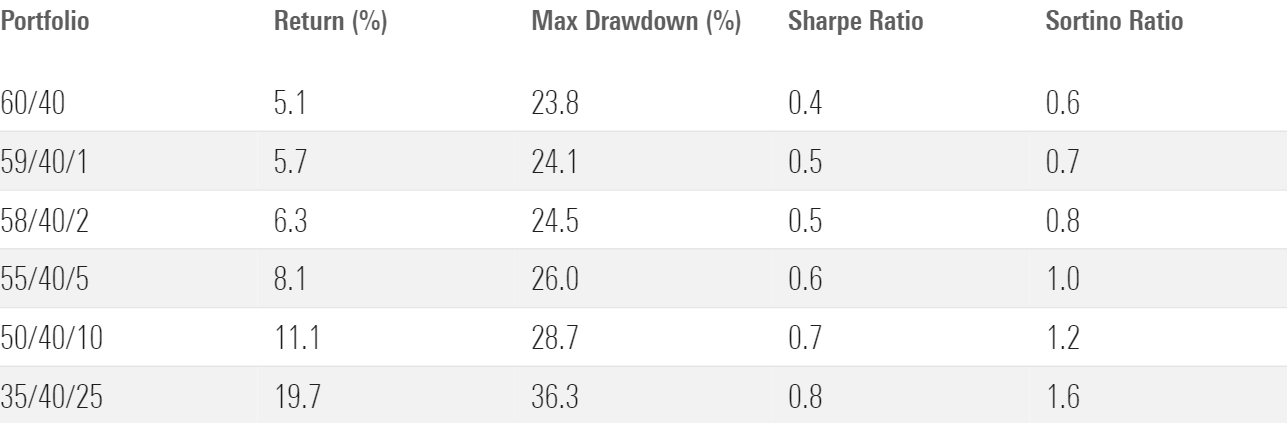

Figure 4 shows the returns of portfolios with 1% to 25% exposure to Bitcoin, obtained from a 60/40 portfolio equity portfolio from February 2014 through December 2023. The greater the allocation to Bitcoin, the higher the portfolio’s return. Despite extreme volatility in Bitcoin, risk-adjusted returns measured by Sharpe and Sortino ratios were higher for Bitcoin portfolios than the 60/40 baseline. But this assumes holding Bitcoin during numerous withdrawals, which requires nerves of steel. A portfolio with a 25% Bitcoin allocation saw a maximum withdrawal over the period of 36%, about 12 percentage points more than the maximum withdrawal for the 60/40 portfolio.

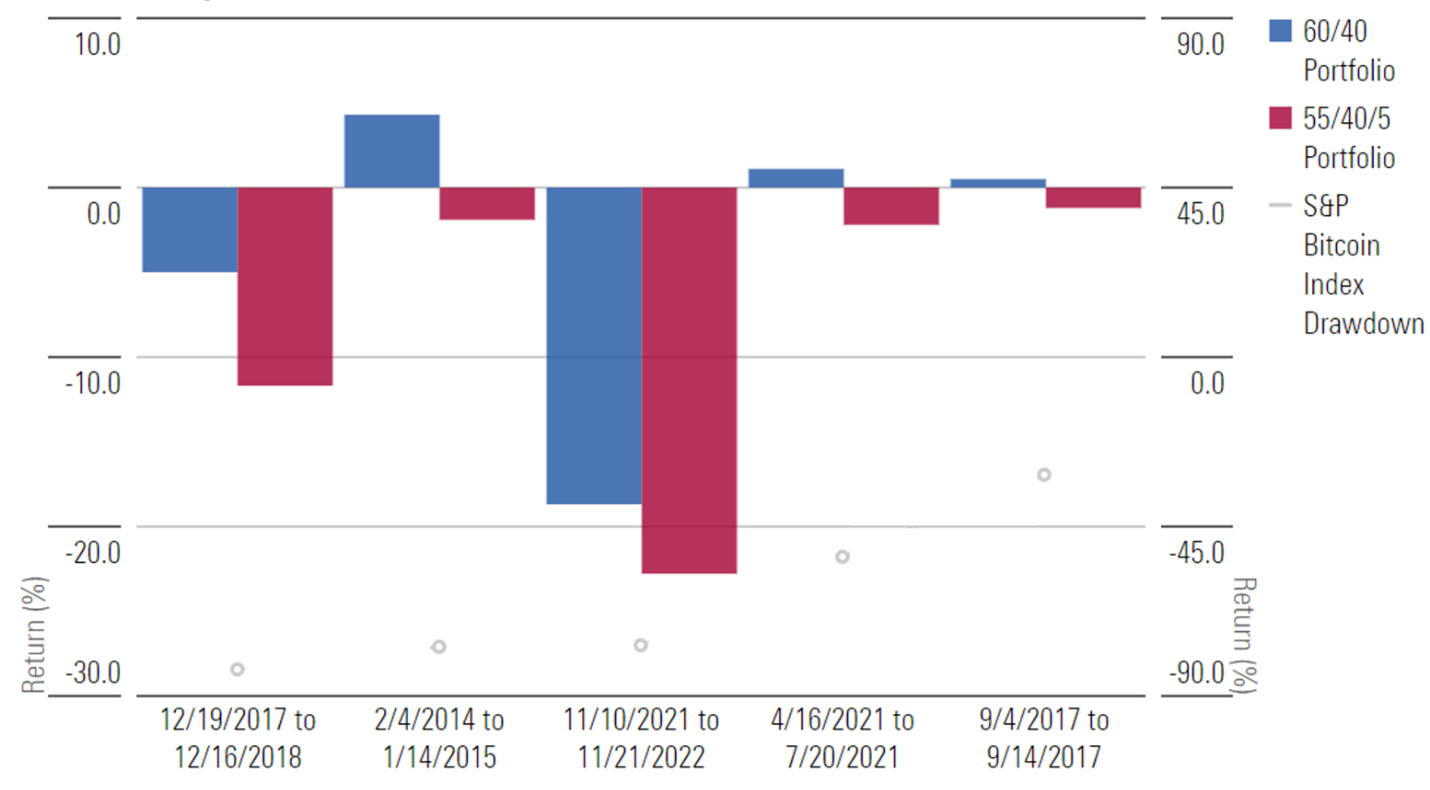

Figure 5 shows the returns of 60/40 portfolios with a 5% allocation to equity-funded Bitcoin compared to the 60/40 baseline during the S&P Bitcoin Index’s five largest drawdowns over its nearly 10-year performance history. The declines in the index ranged from negative 31% to negative 83%. During these five periods of stress, the 60/40 direct portfolio held up better than the portfolio with a 4.4% Bitcoin allocation on average.

The most recent period of Bitcoin stress, which many called the “crypto winter,” lasted from November 2021 until November 21, 2022. While the Bitcoin index fell 77% during that period, the 60/40 portfolio fell 18.7% and the Bitcoin portfolio fell 18.7%. %. A portfolio allocated 5% to Bitcoin dropped 4 percentage points more than that. The decline in cryptocurrencies and the 60/40 level was driven by the Federal Reserve’s aggressive interest rate hikes to stem inflation. Bitcoin’s failure to add diversification when stocks and bonds were falling by double digits shows that it cannot be relied upon as a panacea when the broader economy is going through tough times.

Stocks, bonds and bitcoin

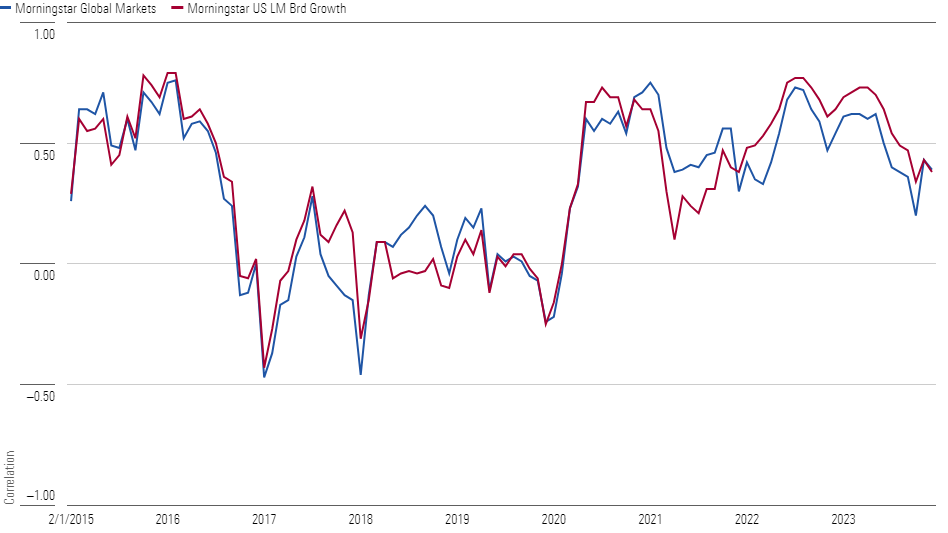

It was previously thought that Bitcoin could offer returns uncorrelated with both stocks and bonds. Bitcoin’s correlation to broader equities and fixed income hovered around zero from its inception in 2009 through most of the 2000s, meaning the impact of financing from stocks or bonds was minimal. But things have changed recently, especially with regard to stocks. Figure 6 shows the one-year rolling correlations between the Morningstar Global Markets indices and the Morningstar US Large-Mid Cap Broad Growth indices for Bitcoin using monthly returns.

Over the past few years, Bitcoin’s one-year rolling correlation with the broader stock markets has been rising, ranging between 0.20 and 0.75 from April 2020 through December 2023. This is a wide range, and there is always a chance that the Bitcoin correlation will stabilize again. About zero, but it is still significant that correlations to stocks have been rising for nearly four years. It stands to reason that risk assets like Bitcoin would have a greater correlation with other risk assets like stocks.

Given Bitcoin’s extreme volatility, instead of having this allocation from broad stocks, an investor can withdraw from riskier areas of stocks such as innovative growth companies. One might assume that cryptocurrency has a greater correlation with riskier stocks. However, Bitcoin’s correlation with the Broad Growth Index from April 2020 through December 2023 was similar to its correlation with the Global Broad Index, ranging from 0.10 to 0.77, so this route likely would not have led to a different outcome.

Overall, Bitcoin volatility can have a significant impact on a standard 60/40 portfolio. With the new accessibility of Bitcoin through ETFs, many investors will look at its great returns and be keen to add it to their portfolios. But before doing so, they must take into account the high volatility of cryptocurrency and how a small change in a portfolio’s risk profile can dramatically impact it.