Recent research indicates that Cardano boasts the most significant developer activity among blockchains. However, there is a noticeable gap between this vibrant activity and its decentralized financial system.

Blockchain analytics platform Santiment’s latest list of cryptocurrency development activities included some amazing networks.

Cardano leads in GitHub commits

On-chain data shows that Cardano has seen an average of 449 developments per day in the last 30 days on GitHub. Developer activity is a critical measure of a network’s dedication to improvement. It measures interest, resources, and experience to improve the blockchain.

It is worth noting that when developers introduce new features and expand their capabilities despite a market downturn, it strengthens investors’ confidence in its lasting sustainability.

Other notable networks that witnessed notable activity include Hedera, Polkadot, and Cosmos, with approximately 282, 281, and 280 development activities. Interestingly, Cardano’s number surpassed that of Ethereum, which only saw 183 commits on GitHub on average.

ADA’s DeFi ecosystem is slowing down

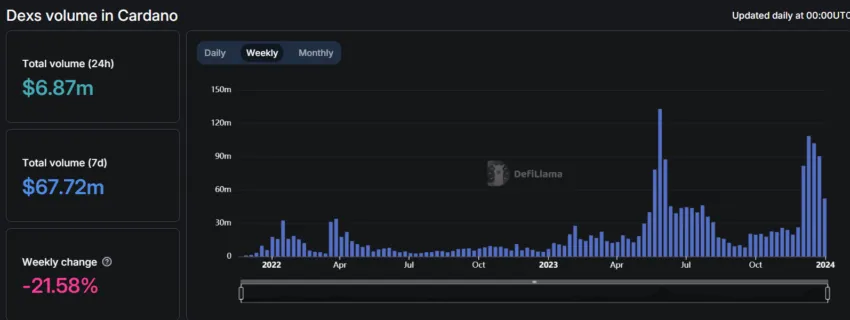

Despite this increase in GitHub commits, Cardano’s decentralized finance (DeFi) ecosystem is facing a decline in participation. It has seen relatively weak network activity since the beginning of the year.

Data from DeFiLlama indicates a rise of just 0.62% in Cardano’s DeFI ecosystem in the past 24 hours.

Read more: 7 cryptocurrencies you should have in your wallet before the next bull run

Further analysis reveals a significant 21.58% drop in trading volume within the network, with approximately $6.87 million traded in the past 24 hours and $67.72 million in the past seven days. Furthermore, stablecoin transfers on the network saw a decline of around 9.15% over the past week.

Cardano’s DeFi currently stands at $356.54 million, mostly led by Indigo, with a 23.94% stake. Notably, Indigo’s dominance coincides with the anticipation surrounding the protocol’s V2 launch, highlighting the evolving dynamics within Cardano’s DeFi space.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased and transparent reporting. This news article aims to provide accurate and timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy and Disclaimer have been updated.