Bitcoin (BTC) and Ethereum (ETH) prices rose significantly in 2023, while Ripple (XRP) lagged behind.

The price movements of the three cryptocurrencies and indicator readings show clearly different trends.

Are cryptocurrencies at risk of reversal?

A recent Santiment post noted that a significant portion of the supply of Bitcoin, Ethereum, and XRP is generating profits. More specifically, more than 80% of the total supply comes from profit.

Historically, the 55-75% area is considered the average, while movements above and below this range are considered higher and lower risk respectively.

Let’s take a look at the price action of Bitcoin, Ethereum, and XRP and determine if a correction is in store.

Bitcoin price breaks out of pattern

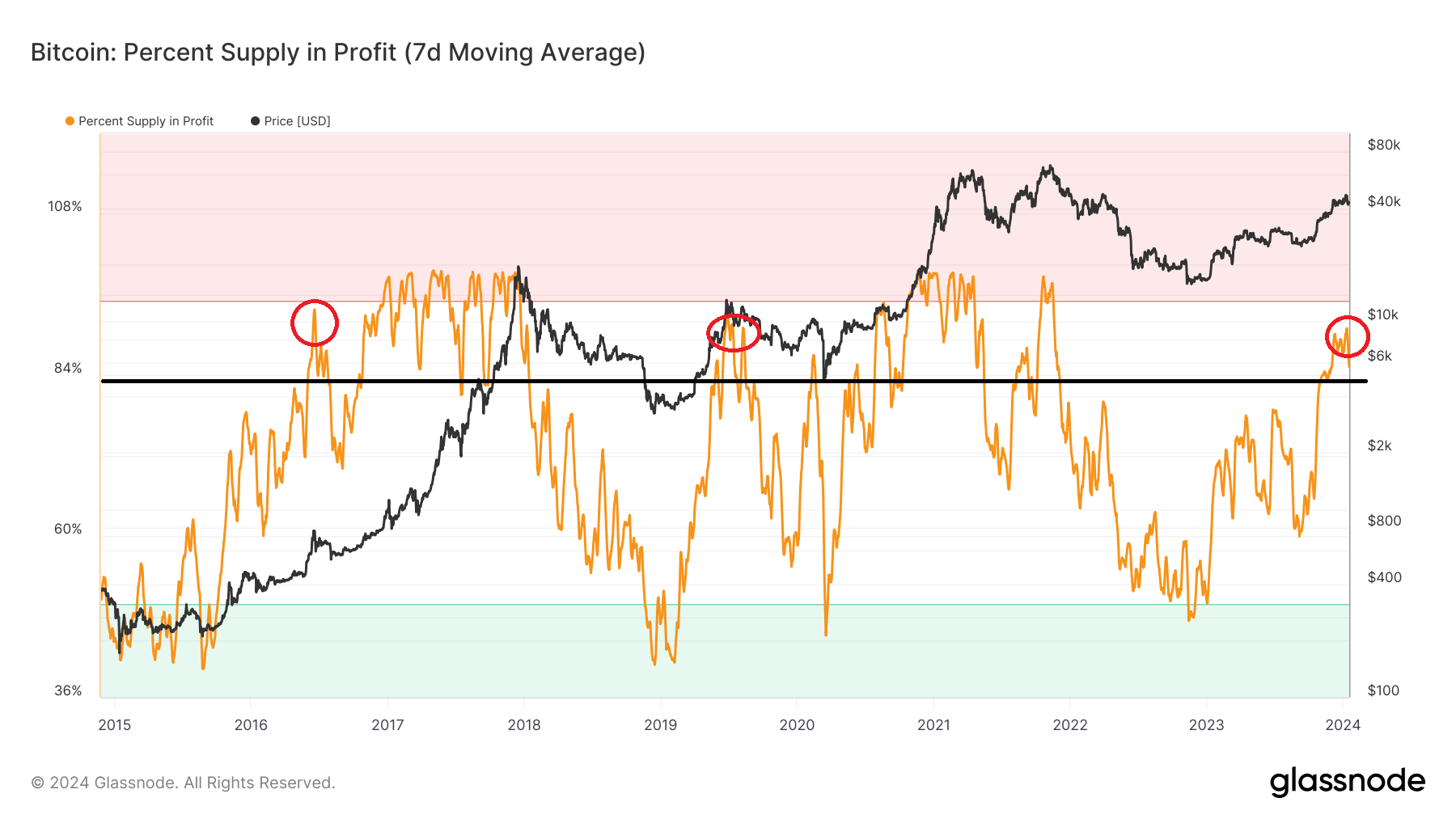

The Profit Supply Percentage (PSP) indicator indicates how much total supply there is in the profit. Naturally, it approaches 100% once the asset price approaches its all-time high and reaches 100% once it breaks its all-time high.

Currently, Bitcoin’s PSP ratio is 85%.

Looking at Bitcoin price movement in the past two market cycles, an interesting development reveals itself. More specifically, the first time the stock price index moved above 80 (black) after the bottom, a major correction followed.

This was evident in 2014 and 2018 (red circle). Interestingly, the PSP index has moved above 80% after bottoming in 2022.

BTC price action is in line with this bearish development. The daily time frame shows that Bitcoin has been declining since hitting a high of $48,970 on January 11, 2024. The decline caused the parallel ascending channel to collapse the next day. Bitcoin validates the channel as resistance.

The daily RSI supports this breakout. Traders use the RSI as a momentum indicator to evaluate whether the market is overbought or oversold. Bulls still have an advantage if the RSI reading is above 50 and the trend is up. The opposite is true if the reading is less than 50.

The daily RSI has generated bearish divergence (green) at the highest level. This occurs when a decrease in momentum is accompanied by an increase in price. The RSI then fell below 50 (red icon) for the first time since October 2023 (green icon). Signs indicate that Bitcoin has reached a local peak.

If the decline continues, Bitcoin could fall 12% to the nearest support at $37,700.

Despite this bearish Bitcoin price prediction, reclaiming the channel support trend line could lead to a 12% increase in the resistance at $48,000.

Read more: What is a Bitcoin ETF?

Ethereum price is consolidating above the resistance level

Unlike BTC, ETH price action is not bearish. This is because ETH broke out of the $2,350 horizontal area, which has served as support and resistance at times since May 2021. Moreover, the price reached a weekly close above this level.

Such a breakout above the pivotal resistance zone is a very bullish development. The fact that the RSI is rising and has just moved into overbought territory legitimizes the upward move.

If the increase continues, ETH could reach the next resistance level at $3,500, which is approximately 40% above the current price.

Despite this bullish prediction for ETH price, a close below $2,350 would negate the ongoing breakout. After that, the price could fall by 25% to the nearest support at $1,900.

Read more: How to buy Ethereum (ETH) and everything you need to know

XRP is hovering below resistance

While the BTC chart looks bearish and the ETH chart looks bullish, XRP is showing an indeterminate trend. This is due to price action and RSI readings.

Price action shows that XRP has fallen below the downward resistance trend line since July. Most recently, the trend line caused rejection on December 28, 2023. The XRP price has not reached the trend line since then.

While the price is still trading above the $0.54 support level, it has almost returned to the level after the rebound failed. Additionally, the Relative Strength Index is below 50. Whether the XRP price breaks down below $0.54 or breaks out of the trend line instead could determine the future trend.

An XRP breakdown could see the price drop by 18% to the nearest support at $0.47, while a breakout from the trend line could lead to a 25% increase to the next resistance at $0.72.

For the latest cryptocurrency market analysis from BeInCrypto, click here.

Disclaimer

In line with Trust Project guidelines, this price analysis article is intended for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to providing accurate and unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy and Disclaimer have been updated.